Mean Reversion Strategy: Understanding, Applying, and Winning with This Market-Neutral Approach

Mean Reversion Strategy: Understanding, Applying, and Winning with This Market-Neutral Approach

Lets talk about mean reversion for a moment here. realistically speaking, In a world where markets often move with unpredictable momentum, traders and investors constantly seek strategies that offer consistent opportunities without being tied to market direction. One such method is mean reversion—a powerful concept rooted in the belief that asset prices eventually revert to their long-term averages.

In this article, we’ll break down the mechanics behind mean reversion, explore why it works, highlight when it fails, and provide actionable steps to implement this strategy in real-world trading.

📉 What Is Mean Reversion?

At its core, mean reversion is the idea that asset prices—stocks, commodities, currencies, or indexes—will tend to return to a historical average (mean) over time. These averages might be based on price, earnings, dividends, or valuation ratios. The fluctuations that temporarily push prices away from their mean are seen as opportunities rather than risks.

Imagine a rubber band being stretched. The further it moves from its resting position (the mean), the stronger the pull back. That’s the essence of mean reversion in financial markets.

⚙️ Why It Works

Several market characteristics support this behavior:

- Market Overreaction: Investors tend to overreact to news, fear, or hype, causing prices to deviate temporarily from their fundamental value.

- Statistical Normalcy: Many assets display a “reversion to the mean” over time, especially in calm or bullish market conditions.

- Behavioral Bias: Cognitive biases often cause irrational buying or selling, which eventually self-corrects.

As Marco Santanche, quant strategist and author of Quant Evolution, puts it:

“Mean reversion is popular for a simple reason: it’s market neutral. It allows traders to profit regardless of the overall market direction.”

🧠 Key Concepts of Mean Reversion

1. Historical Average as Anchor- Mean reversion assumes that every asset has a natural average. For example, a stock might normally trade at a 15x P/E ratio. If it surges to 30x or drops to 7x, the strategy anticipates a reversion to the 15x mean.

- Deviations from the mean are viewed as temporary mispricings—caused by hype, panic, or temporary catalysts.

- The time it takes to revert can differ. Highly liquid stocks may revert in days, while illiquid or news-sensitive assets may take longer.

📈 How to Trade a Mean Reversion Strategy

✅ Step 1: Identify the Right Assets

- Use screeners to find stocks or ETFs with historically consistent behavior. Ideal candidates are those that don't trend wildly but instead oscillate around a central value.

✅ Step 2: Calculate the Historical Mean

- Use moving averages (like the 50-day or 200-day) or statistical metrics like z-scores and Bollinger Bands.

✅ Step 3: Watch for Extreme Deviations

- Look for price movements that deviate two or more standard deviations from the mean.

✅ Step 4: Take Action

- Buy when undervalued (price is significantly below the mean)

- Sell or short when overvalued (price is significantly above the mean)

✅ Step 5: Manage Risk

- Always apply stop-losses, proper position sizing, and clear exit strategies to protect against prolonged divergence or unexpected events.

🧭 When Does It Work Best?

Mean reversion shines in bullish or sideways markets, where asset relationships are stable. This stability allows temporary dislocations to correct themselves.

Santanche explains:

“It works well when the structure of the economy remains intact for weeks or months. That’s when misalignments create profitable windows.”

🛑 When It Fails

There are conditions where mean reversion does not work well:

- Bear Markets: In downtrending markets, relationships between assets break down. Fear-driven selloffs may never "snap back" quickly.

- Fundamental Shifts: If an earnings report signals a permanent change, the historical mean may no longer be relevant.

- Fast Reversals: Trying to time the exact moment of reversal is extremely difficult, especially in volatile environments.

🔧 Indicators to Use with Mean Reversion

To enhance accuracy, you can often combine mean reversion with:

- RSI (Relative Strength Index): To spot overbought and oversold conditions.

- Bollinger Bands: To measure deviation from a moving average.

- Z-Score: To quantify how extreme the deviation is.

- Standard Deviation: To assess volatility.

Pair these with earnings calendars, news catalysts, and volume spikes to avoid false signals.

🧩 Final Thoughts

Mean reversion isn’t a guaranteed win, but it offers traders a structured, risk-managed way to profit from the natural ebb and flow of markets. When paired with disciplined execution and technical tools, it becomes a timeless weapon in a trader’s arsenal.

Remember, this strategy works best for those who think rationally when others panic and who can recognize when markets are temporarily off-balance.

📌 Related Content Ideas You Can Expand Into More Articles:

- Top 5 Indicators for Mean Reversion Strategies

- Mean Reversion vs Trend Following: Which Wins?

- The Psychology Behind Market Overreaction

- How to Backtest a Mean Reversion Strategy

- Bollinger Bands for Beginners: A Visual Guide

- What Makes a Stock Mean-Reverting?

- Combining RSI and Moving Averages for Swing Trades

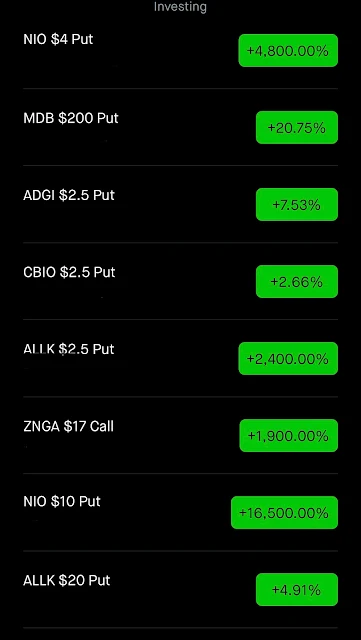

- Mean Reversion Strategies in Options Trading

- Pairs Trading Explained: A Market-Neutral Strategy

- What Mean Reversion Teaches Us About Patience in the Market