How Do I Leg-In to an Existing Option Position? A Comprehensive Guide

How Do I Leg-In to an Existing Option Position? A Comprehensive Guide

Legging-in to an existing option position is a strategic maneuver used by traders to build multi-leg option strategies over time rather than entering all legs simultaneously. This approach allows for greater flexibility and the opportunity to take advantage of favorable market conditions. In this guide, we will explore what it means to leg-in to an option position, the benefits and risks involved, and provide a step-by-step process for executing this strategy effectively.

What Does It Mean to Leg-In to an Option Position?

Legging-in refers to the process of adding one or more option contracts to an existing position at different times rather than initiating a multi-leg option strategy all at once. For example, a trader might start by buying a call option, then later sell a call option at a higher strike price to create a bull call spread. The key advantage of legging-in is that it allows traders to enter each leg of the strategy at potentially more favorable prices as market conditions evolve.

Why Consider Legging-In to an Option Position?

- Improved Entry Prices: By legging-in, traders can wait for better pricing on subsequent legs of their strategy, potentially reducing the overall cost or increasing potential profits.

- Market Flexibility: This approach allows traders to adapt to changing market conditions, such as shifts in volatility or price movements, before completing the strategy.

- Risk Management: Traders can control their risk exposure by gradually building the position. If the market moves against the initial leg, they can choose not to complete the strategy, limiting potential losses.

- Strategic Adjustments: Legging-in provides the flexibility to modify the strategy as the market changes, rather than being locked into a predetermined position.

Step-by-Step Guide to Legging-In to an Option Position

Identify the Initial Leg

- Choose Your First Option: Begin by selecting the option that aligns with your initial market outlook. For example, if you’re bullish on a stock, you might start by buying a call option.

- Set Entry Criteria: Define the conditions under which you will enter the first leg, such as a specific price target, level of implied volatility, or market trend.

Monitor Market Conditions

- Watch for Changes: After entering the first leg, closely monitor the market for changes that could affect your strategy. This includes tracking the underlying asset’s price movement, shifts in volatility, and other relevant factors.

- Analyze Potential Outcomes: Consider how these market changes might impact the second leg of your strategy. For example, if volatility increases, it might be a good time to sell an option to capitalize on the higher premiums.

Determine the Timing for the Second Leg

- Set Triggers for Entry: Decide on the conditions that will trigger your entry into the second leg. This could be a specific price movement in the underlying asset, a certain level of time decay, or a change in market sentiment.

- Evaluate Risk and Reward: Before entering the second leg, reassess the overall risk and reward profile of your strategy. Ensure that the potential benefits justify the risks involved.

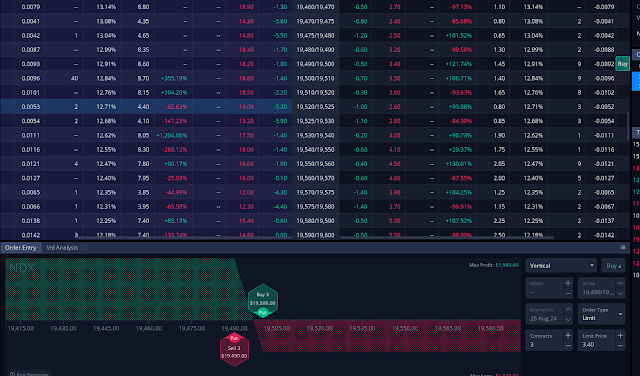

Execute the Second Leg

- Place the Trade: Once your criteria are met, execute the second leg of your strategy. For example, if you initially bought a call, you might now sell a call at a higher strike price to create a spread.

- Ensure Proper Execution: Confirm that the trade is executed as intended. Check the order fills and verify that the new leg integrates smoothly with the existing position.

Monitor and Manage the Combined Position

- Track Performance: Regularly monitor the performance of your combined position. Use analytical tools provided by your trading platform to assess how the strategy is performing relative to your expectations.

- Adjust as Needed: If market conditions change further, consider whether additional adjustments are necessary. You might add more legs, roll existing positions to different strikes or expiration dates, or close part of the position to lock in profits or limit losses.

Close or Adjust the Position

- Decide on Exit Strategy: As your position matures, decide on the best time to close the position or adjust it further. Consider factors such as the remaining time until expiration, the current value of the options, and your overall market outlook.

- Execute the Exit or Adjustment: When you’re ready to exit or adjust, execute the necessary trades to close out your position or modify it according to your updated strategy.

Benefits and Risks of Legging-In

Benefits:

- Potential for Better Pricing: Legging-in allows traders to take advantage of favorable price movements for each leg, potentially improving the overall profitability of the strategy.

- Increased Flexibility: Traders can respond to market changes by adjusting their strategy as they build it, rather than being locked into a multi-leg position from the start.

- Controlled Risk Exposure: By building the position gradually, traders can limit their exposure to adverse market movements, reducing the potential for large losses.

Risks:

- Execution Risk: The market may not move as expected, making it difficult or impossible to complete the strategy as planned, which could result in losses.

- Timing Challenges: Successfully legging-in requires precise timing and careful market analysis. Poor timing could lead to unfavorable pricing or increased risk.

- Incomplete Strategies: If market conditions change drastically after the first leg is placed, the trader may be left with a suboptimal or incomplete strategy, which could limit profit potential or increase risk.

Best Practices for Legging-In to an Option Position

- Start with a Clear Plan: Define your strategy and entry criteria for each leg before you begin trading. This will help you stay disciplined and avoid making impulsive decisions based on short-term market movements.

- Use Analytical Tools: Leverage the tools available on your trading platform, such as option Greeks, volatility indicators, and price charts, to inform your decisions and optimize your timing.

- Stay Informed: Keep up to date with market news, earnings reports, and other events that could impact the underlying asset or the broader market. Staying informed will help you make better decisions when legging-in.

- Manage Risk Carefully: Consider using stop-loss orders or other risk management techniques to protect your position if the market moves against you. This is particularly important when legging-in, as the timing of each leg can significantly impact overall risk.

- Review and Adjust: After completing the strategy, regularly review its performance and be ready to make adjustments if necessary. The market is constantly changing, and staying proactive will help you maximize the strategy’s effectiveness.

Conclusion

Legging-in to an existing option position is a sophisticated trading technique that offers flexibility and the potential for improved profitability. By carefully planning your entry points, monitoring market conditions, and managing your risk, you can effectively build and adjust multi-leg option strategies over time. While this approach comes with its challenges, such as execution risk and timing difficulties, the benefits of better pricing, increased flexibility, and controlled risk exposure make it a valuable tool for experienced traders. With the right strategy and discipline, legging-in can enhance your trading performance and help you achieve your financial goals.