Why Purchase Call Options?

Why Purchase Call Options?

Call options are a powerful financial instrument that gives investors the potential to profit from rising asset prices while managing risk. Whether you are looking to leverage your investment, speculate on a bullish market, or hedge against future price increases, call options can be an effective tool in your trading strategy. This article will explore the key reasons why you might consider purchasing call options, how they work, and the potential advantages they offer.

Understanding Call Options

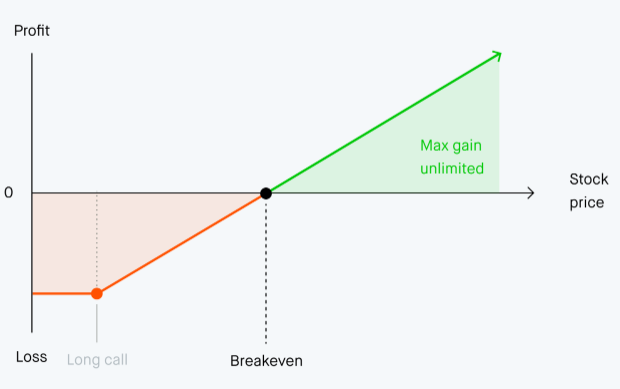

Definition: A call option is a contract that gives the holder the right, but not the obligation, to buy a specified quantity of an underlying asset (such as a stock) at a predetermined price (known as the strike price) within a specified period (before the option’s expiration date).

How It Works: When you buy a call option, you are essentially purchasing the right to buy the underlying asset at the strike price. If the price of the underlying asset rises above the strike price, the value of the call option increases. Conversely, if the asset’s price remains below the strike price, the call option may expire worthless, and you lose the premium paid for the option.

Reasons to Purchase Call Options

Leverage and Amplified Returns

- Definition: Call options provide leverage, allowing you to control a larger position with a relatively small investment. This means you can potentially achieve higher returns compared to directly purchasing the underlying asset.

- How It Works: If the price of the underlying asset rises above the strike price, the value of your call option increases, often at a higher percentage than the underlying asset itself. This leverage can lead to significant profits if your market prediction is correct.

Speculating on Price Increases

- Definition: Call options are commonly used by traders to speculate on an asset’s price increase. If you believe that a particular stock, index, or asset is undervalued or poised for a rise, buying call options allows you to profit from the anticipated upward movement.

- Benefit: Call options allow you to capitalize on bullish market conditions with a limited upfront investment, potentially yielding high returns if the market moves in your favor.

Limited Risk with Defined Loss

- Risk Management: Unlike buying the underlying asset directly, where losses can accumulate as the asset’s price declines, purchasing call options offers a defined risk. The maximum loss is limited to the premium paid for the option.

- Defined Loss: Even if the underlying asset’s price does not rise as expected and the call option expires worthless, your loss is capped at the premium you paid, allowing you to manage your risk more effectively.

Hedging Against Price Increases

- Price Protection: Call options can be used to hedge against future price increases in assets you plan to purchase. For example, if you expect a stock’s price to rise but are not ready to buy it outright, you can purchase a call option to lock in the current price.

- Cost Efficiency: By purchasing a call option, you can secure the right to buy the asset at a set price in the future, protecting yourself against price increases while only paying a fraction of the asset’s current price.

Generating Income through Covered Calls

- Income Strategy: Investors who already own a stock can sell call options against their holdings, a strategy known as writing covered calls. This allows them to generate additional income through the premiums received from selling the call options.

- Limited Downside: If the stock’s price remains below the strike price, the call option expires worthless, and the investor keeps the premium. If the stock’s price rises above the strike price, the stock may be sold, but the investor still benefits from the increase up to the strike price plus the premium.

Taking Advantage of Market Volatility

- Volatility Play: Call options are particularly valuable in volatile markets, where prices are expected to fluctuate significantly. In such environments, the potential for large price swings makes call options an attractive tool for traders looking to capitalize on market movements.

- Flexibility: Investors can purchase call options to gain exposure to potential price increases without committing large amounts of capital, making them a flexible tool for navigating uncertain market conditions.

Tax Benefits

- Tax-Efficient Hedging: In some cases, purchasing call options may offer tax advantages compared to directly purchasing the underlying asset. By using call options to gain exposure to an asset, you can potentially defer capital gains taxes while still benefiting from price increases.

Risks of Buying Call Options

While call options offer numerous benefits, it’s essential to understand the associated risks:

Premium Loss:

- If the underlying asset’s price does not rise above the strike price, the call option may expire worthless, resulting in a loss of the premium paid. This is the maximum risk associated with buying call options.

Time Decay:

- Options lose value as they approach expiration due to time decay (Theta). If the anticipated price increase does not occur quickly, the option’s value may erode, even if the underlying asset eventually moves in the expected direction.

Volatility Risk:

- While call options benefit from increased volatility, sudden drops in volatility can reduce the value of your options. This is particularly relevant in markets where volatility is expected to decrease.

Complexity:

- Options trading is more complex than buying and selling stocks. It requires a good understanding of options pricing, the Greeks (Delta, Gamma, Theta, and Vega), and market dynamics. New investors should educate themselves thoroughly before trading options.

Conclusion

Purchasing call options can be a powerful strategy for speculating on price increases, leveraging investments, hedging against future price rises, and generating income. Whether you are a bullish investor looking to capitalize on rising asset prices or a conservative investor seeking to hedge against potential price increases, call options offer a range of benefits. However, it is crucial to understand the risks involved, including the potential loss of the premium paid and the impact of time decay. With careful planning and a solid understanding of options, call options can be a valuable addition to your investment toolkit.