How to Trade Options with Just $500: Smart Strategies for Small Accounts

💰 How to Trade Options with Just $500: Smart Strategies for Small Accounts

Think you need thousands of dollars to trade options? Think again.

If you’re working with a small account—say, $500—you might feel like you're sitting at the kids' table in a high-stakes casino. But in reality, options trading is one of the few areas in finance where a small account can grow steadily, with limited risk and high reward—if you know how to play it smart.

In this guide, we'll break down how to trade options with just $500, covering the best strategies, risk management tips, and tools to help you win more, lose less, and grow your account one trade at a time.

🔍 Is $500 Really Enough?

Yes, but let’s be realistic.

A $500 account won’t make you rich overnight, and it limits which strategies you can use. You won't be selling naked calls or buying high-premium LEAPS. But you can still:

-

Learn the markets

-

Build consistency

-

Compound small wins

-

Protect your downside

Small accounts are not a weakness—they're a training ground for mastering discipline and strategy.

🧠 Understand the Basics First

Before jumping into trades, you need to understand:

-

What an option is: A contract that gives you the right (but not the obligation) to buy or sell an underlying asset at a specific price before a set date.

-

Calls vs. Puts:

-

Call = Bullish (betting price goes up)

-

Put = Bearish (betting price goes down)

-

-

Premium: What you pay (or collect) for the option

-

Strike price: The price at which the contract can be exercised

-

Expiration: When the option expires

If you're already comfortable with these terms, let's move into how to actually grow your $500.

⚖️ Rule #1: Focus on Defined-Risk Strategies

You cannot afford undefined risk with a $500 account. That means no naked options, no spreads without protection, and no YOLO earnings bets.

Instead, use strategies that:

-

Require low capital

-

Offer limited loss / limited profit

-

Allow for high win probabilities

The 3 best strategies for a $500 account are:

🟢 1. Credit Spreads – Get Paid Upfront with Defined Risk

This is the king of small account trading strategies. Why? Because:

-

You collect a credit up front

-

Risk is limited

-

It’s possible to trade with as little as $100 per position

🧪 Example – Bull Put Credit Spread:

Stock: $50

-

Sell the $48 Put for $1.00

-

Buy the $45 Put for $0.50

-

Net Credit = $0.50

-

Max Risk = $2.00 – $0.50 = $1.50 (or $150)

If the stock stays above $48 by expiration, you keep the $50 profit.

You can do 2 such spreads in a $500 account and still leave room for commissions or wiggle room.

🔥 Best Time to Use:

-

Bull Put Spread: When you think the stock will stay above support

-

Bear Call Spread: When you think the stock won’t break resistance

✅ Tip: Use high-probability setups (strike delta 15–30), and close early at 50–70% profit.

🔴 2. Buying Cheap Long Calls or Puts – Pure Directional Plays

When you really believe a stock is going to break out or break down, buying a single cheap call or put can turn $20 into $60 or $100.

🧪 Example:

You buy a $0.30 put contract ($30 total) for a stock trading at $20, expecting a move down. If the stock drops and volatility spikes, your option might go up to $0.80 or $1.00 = 100–200% return.

Pros:

-

High return potential

-

Simple to execute

Cons:

-

High probability of loss if wrong

-

Time decay works against you

✅ Tip: Use this only when there’s a clear breakout, supported by volume, trend, or news.

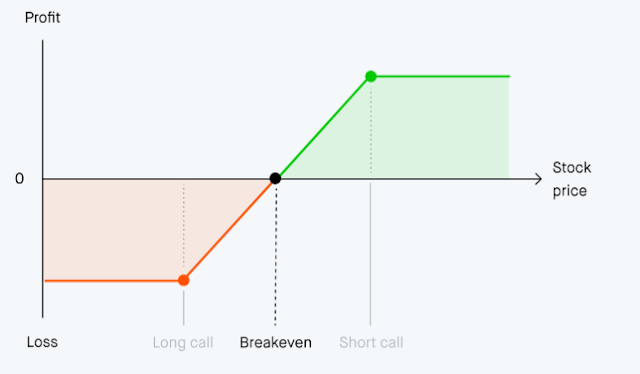

🟡 3. Debit Spreads – Lower Cost, Lower Risk Directional Trades

A debit spread (like a call debit spread) allows you to take a bullish or bearish position but reduce the cost and time decay compared to buying naked options.

🧪 Example – Call Debit Spread:

Stock: $40

-

Buy 40 Call for $1.50

-

Sell 45 Call for $0.75

-

Net Cost = $0.75 ($75)

If the stock closes at or above $45, you earn $5.00 – $0.75 = $4.25 or $425 max profit.

Great for small accounts because you get:

-

Lower cost entry

-

Defined max loss

-

Direction exposure with better odds

✅ Tip: Use when you have high conviction about direction but want protection from time decay.

📊 How to Find the Right Trades

You're working with limited capital, so make every trade count. Here’s how:

🔍 Use Screeners:

-

Finviz, TradingView, and Thinkorswim scanners can help you find:

-

Stocks near support/resistance

-

Oversold/overbought setups

-

Earnings plays (but be cautious)

-

⚙️ Focus on:

-

Liquidity: Only trade tickers with tight bid/ask spreads and high open interest

-

IV Rank: Higher IV means higher premiums for credit spreads

-

ETFs: Consider SPY, QQQ, IWM for cheap liquid options

🧠 Use Chart Analysis:

-

Support/resistance zones

-

Breakouts

-

Volume confirmation

-

Candlestick patterns

Even a basic understanding of charts can give you an edge.

💵 Risk Management: Protect Your Capital at All Costs

With $500, every dollar matters.

🔐 Follow These Rules:

-

Only risk 5–10% per trade: That’s $25–$50 max

-

Set stop-losses: Don’t let losers run

-

Take profits early: If a trade hits 50–70% of your max profit, lock it in

-

Avoid overtrading: Stick to 1–2 good setups per week

Remember: capital preservation > hitting home runs

🛠 Tools & Platforms for Small Account Traders

Not all brokers are created equal. Choose platforms that support zero-commission trading, small trade sizing, and user-friendly options chains.

Top Picks:

-

Robinhood: Easy to start with, limited features

-

Webull: Good for charting, has multi-leg options

-

Tastytrade: Built for options traders, great for credit spreads

-

TD Ameritrade (Thinkorswim): More advanced but powerful

⚠️ Note: Always practice on paper trading first, especially if you’re new.

⏳ Final Thoughts: Grow It Slow and Smart

Trading options with $500 isn’t about “getting rich.” It’s about building a foundation, learning to manage risk, and making strategic decisions that compound over time.

Here’s a quick recap:

✅ Focus on credit spreads and cheap directional trades

✅ Always manage risk and avoid overleveraging

✅ Choose liquid, affordable tickers

✅ Take consistent small wins

✅ Grow your account with discipline, not luck

With patience, practice, and a rules-based approach, $500 can become $600, then $800, then $1,200…

📚 More Helpful Reads:

-

“Best Credit Spread Strategies for Weekly Income”

-

“How to Use Theta and Delta to Your Advantage”

-

“Growing a $500 Options Account: Real Case Studies”

#options #smallaccounttrading #creditspreads #500dollarchallenge #tradingstrategies #financialfreedom